Medical Plan Options

Windstream offers three high-deductible health plan options that all offer access to a Health Savings Account (HSA) for tax-free health care spending.

Windstream offers three high-deductible health plan options that all offer access to a Health Savings Account (HSA) for tax-free health care spending.

HSA company contribution! If you are enrolled in a Windstream medical plan and HSA, Windstream will contribute to your HSA – you will receive up to $600 deposited in a prorated, tax-free amount of $23.08 each pay period.

What is included?

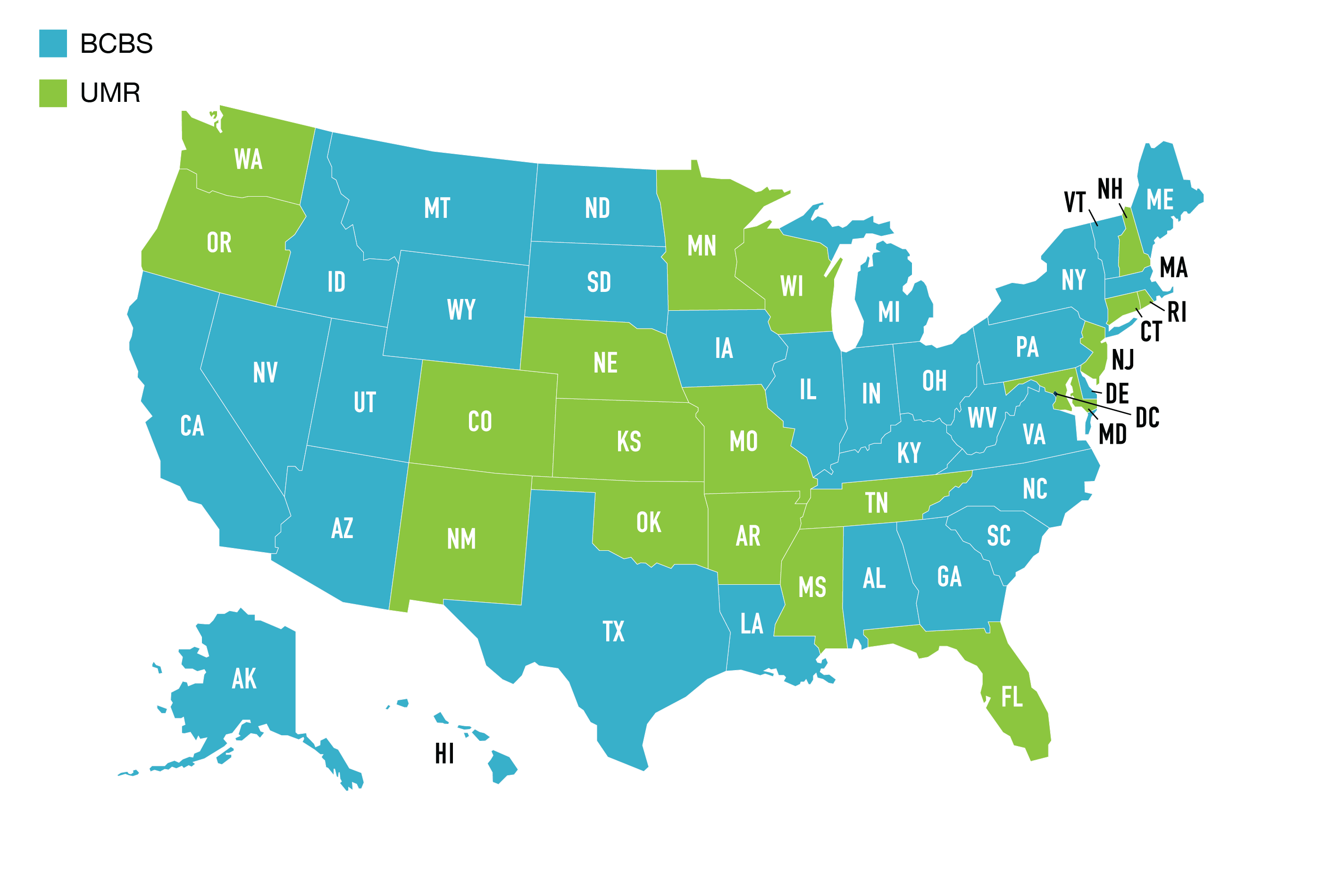

- Your choice of carriers: Blue Cross Blue Shield (BCBS), UMR and Surest. Employees enrolled in BCBS or UMR, in each state there is one carrier that has a lower premium cost than the other. This represents the larger discount that doctors and facilities have with one carrier over the other in a given state. The Surest Choice Plan uses a single carrier; your network will be the UnitedHealthcare Choice Plus network, which is the same network as UMR.

- Prescription drug coverage. Coverage for prescription medications comes with each plan and is provided by Express Scripts.

- Free in-network preventive care. Services, such as annual physicals, certain immunizations and routine screenings, are fully covered at 100%. That means you pay nothing.

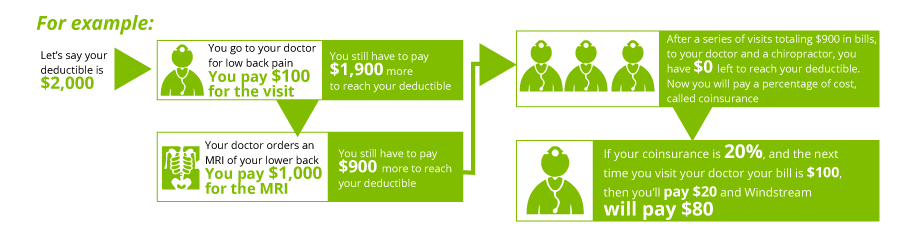

- Annual deductible. You pay for initial medical and prescription drug costs until you meet your annual deductible.

- Coinsurance. After meeting your deductible, you pay a percentage of eligible costs through coinsurance, then the plan pays the rest. Keep in mind: With the 1850 Plan — per IRS regulations — coinsurance for any person covered under an employee plus dependent plan begins only after the entire family deductible of $3,700 has been met. Tax-saving opportunity. If eligible, you can contribute to an HSA on a before-tax basis to help pay for your eligible out-of-pocket health care costs –now or in the future. Your HSA funds roll over year after year; they are always yours to keep!

- Out-of-pocket maximum. Each plan protects you by capping the total amount you will pay each year for in-network medical care. Once you meet your out-of-pocket maximum, the plan pays 100% of your eligible

expenses for the rest of the year. Medical premiums are not included in the out-of-pocket maximum. - If you are enrolled in the BCBS or UMR medical plan, Included Health is your no-cost personal care team here to help you manage your healthcare. From finding a top doctor in your network to explaining your health benefits or medical bills to getting an expert second opinion, they’ll get the help you need, when you need it.

- Employees enrolled in the Surest Choice plan, may contact the Surest Member Services for assistance with finding a doctor in your network to explaining your health benefits or medical bills or getting an expert opinion.

Compare the plans

If you enroll in the 1850 HDHP Plan, 3200 HDHP Plan, 6550 HDHP Plan or the 4000 Copay Plan, these plans are offered through your choice of Blue Cross Blue Shield (BCBS) or UMR. In each state, one carrier has a lower cost than the other, referred to as Carrier 1. This represents the larger discount that doctors and facilities have with one carrier over the other in a state. No matter which Windstream medical plan you choose, the benefits covered by each option are the same.

The Surest Choice Plan uses a single carrier; your network will be the UnitedHealthcare Choice Plus network, which is the same network as UMR.

All plans cover in-network preventive care such as blood pressure and cholesterol tests, mammograms, colonoscopies, screenings for osteoporosis, vaccines and well-woman visits – all at no cost to you! Be sure to follow the recommended age guidelines outlined in the medical summary plan description when scheduling your preventive care.

Compare Your Costs

2024 Rates

Your 2024 medical plan costs

Spousal Surcharge

When reviewing the costs for medical coverage, keep in mind that Windstream has a spousal surcharge of $100 per month. The spousal surcharge is applied if your spouse has coverage available through his/her employer but chooses to be on a Windstream medical plan. If your spouse is not offered coverage through his/her employer or is not employed, the surcharge does not apply. If your spouse is employed by Windstream, the surcharge also does not apply.

Tobacco use surcharge

A $50 monthly surcharge will be applied to employees and spouses who use tobacco products. During enrollment, you will be asked to attest to your and your enrolled spouse’s tobacco status. By completing the tobacco cessation program, the surcharge can be stopped and removed prospectively during the year by calling 888.850.1712.

What to expect when you go to the doctor

Your doctor will ask to see your new card on your first visit. The office will bill your insurance for your visit, and you will get a statement showing the cost of the visit that will be applied toward your deductible and the discount applied. Your doctor will send you a bill for the balance. You will be responsible for the full-cost until your deductible is met. Your doctor may bill you up-front if your deductible hasn’t been satisfied. Here’s how it works.

Be prepared. Not all hospitals and surgeons charge the same price for the same services. If you anticipate extensive medical care or are planning an elective surgery, you can review the average cost of most services, and the quality of the facilities before you make an appointment.

Be prepared. Not all hospitals and surgeons charge the same price for the same services. If you anticipate extensive medical care or are planning an elective surgery, you can review the average cost of most services, and the quality of the facilities before you make an appointment.

No matter which medical plan you choose, the benefits covered by each option are the same, and each offers the same large network of providers. Through these plans you are eligible for preventive care such as blood pressure and cholesterol tests, mammograms, colonoscopies, screenings for osteoporosis, vaccines and well-woman visits – all at no cost to you! Be sure you use an in-network provider and follow the recommended age guidelines outlined in the medical summary plan description when scheduling your preventive care.

Enroll in a Health Savings Account (HSA) for additional financial protection

While getting preventive care and doing your best to stay healthy are important first steps toward keeping medical costs down, anyone can face unavoidable health conditions and expenses. That’s why it’s important to plan ahead. A Health Savings Account (HSA) offers an opportunity to save tax-free today so you’ll be prepared in the future. An HSA is a unique account type permitted by the IRS that can be used with Windstream’s medical plans. In addition to having pre-tax contributions, earnings are also tax-free, and the use of funds for qualified medical expenses is not taxable income. It’s a triple win from a tax standpoint! See the My Wealth section for more detail.

Medical Plan Terms You Need to Know

Coinsurance – Your share of the costs after the deductible is met. You may receive an added coinsurance benefit for preventive prescriptions. See description below.

Deductible – The amount you owe before your health insurance plan begins to pay. The deductible may not apply to all services.

Embedded Deductible – For all plans except the 1850 Plan, this is equal to the employee only plan deductible for any covered person on an employee + family member plan. This means a single member of your family can meet the embedded deductible and enter the coinsurance phase without all covered members reaching the full plan deductible. Per IRS regulations, the 1850 Plan does NOT offer an imbedded deductible feature.

In-Network – A provider who has a contract with your health insurer or plan to provide services or prescriptions to you at a discount. You will likely pay extra for out-of-network usage and can be billed the balance by

the provider.

Out-of-Pocket Maximum – The most you pay during the year before Windstream begins to pay 100% of the allowed amount.

Preventive Medical Care – Windstream health plans cover a set of preventive services at no cost to you even if you haven’t met your deductible. Covered preventive care services include biometric screenings, mammograms, colonoscopies, vaccines, well-woman and well-child visits. Be sure to follow the recommended age guidelines outlined in the medical summary plan description when scheduling your preventive care. For a complete list, visit healthcare.gov/coverage/preventive-care-benefits.

Preventive Prescription Drugs – Certain medications are defined by the IRS as preventive. A complete preventive medication list is available on the Prescription Drug Program page. Preventive prescription medications are available at a coinsurance rate whether or not you have met the deductible on all plans.

Helpful Links |

Need Help?

Find a provider:Summary of Benefits Coverage (SBCs)For all non-bargaining employees. Blue Cross Blue Shield

UMR

Telemedicine Plans |